Teaching Kids About Money

How I Helped My Kiddos Get Good With Money…

The secret to teaching kids about money… I let them spend it. 😂

You see, money habits don’t just show up fully formed—we build them, little by little, often from a young age.

I’ve seen this play out firsthand with my kids, and let me tell you, it’s been really amazing to witness their journey.

When I first started giving my kiddos the chance to earn their own money, they were over the moon.

They’d hustle through their chores and were ready to spend it as soon as they possibly could. It didn’t matter what they bought—candy, cheap toys (what I kindly referred to as “junk”), whatever caught their eye—they just wanted to spend it.

I cringed a bit inside each time they picked something I knew would break or be forgotten in a day, but I bit my tongue and let them practice.

And practice they did. For a while, it felt like we were stuck on repeat—earn, spend, regret, repeat.

Slowly, like all new habits, something clicked. They started hesitating before spending their hard-earned money. I’d watch as they’d hold an item, then put it back, asking themselves, “Is this worth it?”

Actually, my favorite question they asked themselves was “How much poop do I have to pick up to buy this?” 🤣

It was magic – the magic of habit formation.

We gave them time and space to learn. This led to feeling safe to explore, to mess up, to grow. It was the ability to practice a skill that’s just as important as reading or riding a bike: managing money.

Because here’s the thing—money is a skill. It’s a habit. Teaching kids about money is important, because you can’t just expect them to automatically know how to deal with it.

And, just like any habit, it’s tied up with our emotions, our values, and even our sense of safety.

If we didn’t get a chance to learn healthy money habits early on, or if we absorbed our caregivers’ complicated beliefs about money, we might find ourselves struggling with finances as adults—often in ways that reflect the deeper patterns of our personalities.

That’s why I’m such a big believer in letting kids practice with money. Two years into building this habit, my kids are more interested in saving their money than spending it. And I didn’t even have to preach at them once about the importance of saving.

😂

It’s an absolute privilege for them to experience money without the pressure of scarcity and they came to the importance of saving out of preference, not pressure.

Not all of us have (or had) these experiences, which is why I love working with adults to unearth those deeper habits and rewrite them into something that serves them better. It’s so healing!

If you’ve been feeling like your relationship with money isn’t quite where you want it to be, I’d love to chat. Teaching kids about money is important, but adults need to learn about money too.

Schedule a discovery call, and let’s dive into what’s behind those habits—and how to build something new.

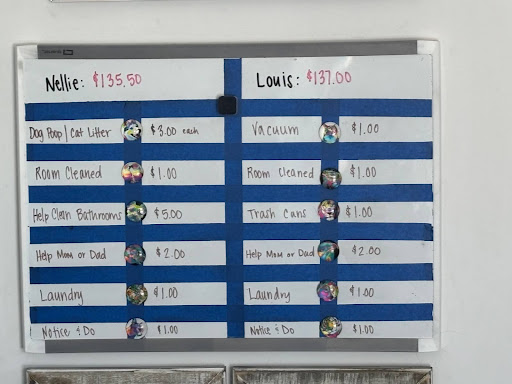

And hey, if you’re curious about how our chore system works (because it’s been a game-changer for teaching self-management and keeping our household running smoothly), shoot me a message. I’d be happy to share the details.

You’ve got this!

View comments

+ Leave a comment